How to Finance a Custom Home Build

Financing a custom home works differently than buying an existing house. Instead of a traditional mortgage, you'll need a construction loan that disburses funds in stages as your home is built, then converts to permanent financing once construction completes. Most custom home buyers in Austin choose between one-time close construction-to-permanent loans or two-time close loans requiring separate closings for construction and permanent financing.

This guide explains how construction loans work, what lenders require, how the draw process functions, and how to choose the right financing structure for your project.

Construction Loan Basics

A construction loan is short-term financing that pays for building your home in scheduled installments called "draws" as construction progresses. Unlike traditional mortgages that provide a lump sum at closing, construction loans disburse funds incrementally after completing major milestones.

How draws work:

Your lender releases funds in 4-6 stages throughout construction:

Initial draw (10-20%): At closing or after foundation

Foundation complete (15-20%): After foundation inspection

Framing complete (20-25%): After framing and roof

Rough-ins complete (15-20%): After HVAC, electrical, plumbing inspections

Interior finishes (15-20%): After drywall and finishes substantially complete

Final draw (5-10%): After Certificate of Occupancy

Why draws matter: This protects you and the lender by ensuring money releases only as work progresses. If your builder walks off mid-project, the lender hasn't funded work that doesn't exist.

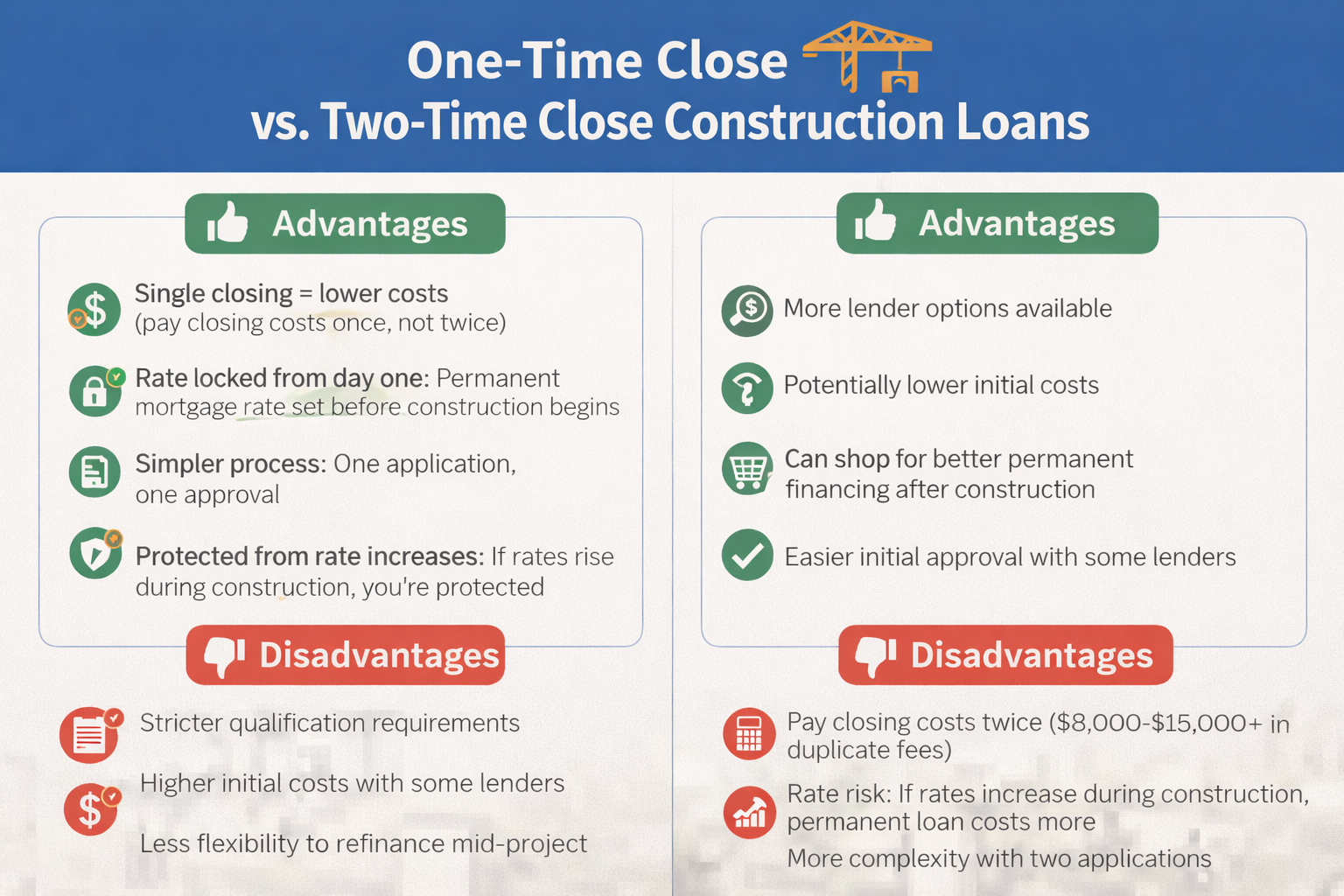

One-Time Close vs. Two-Time Close Loans

One-Time Close Construction-to-Permanent Loan (Recommended)

You close once at the beginning. The loan covers construction and automatically converts to a permanent mortgage when complete.

Advantages:

Single closing = lower costs (pay closing costs once, not twice)

Rate locked from day one: Permanent mortgage rate set before construction begins

Simpler process: One application, one approval

Protected from rate increases: If rates rise during construction, you're protected

Disadvantages:

Stricter qualification requirements

Higher initial costs with some lenders

Less flexibility to refinance mid-project

Best for: Buyers who want rate certainty, have strong credit, and are working with established builders.

Two-Time Close Construction Loan

You close twice: once for construction, again for permanent mortgage when finished.

Advantages:

More lender options available

Potentially lower initial costs

Can shop for better permanent financing after construction

Easier initial approval with some lenders

Disadvantages:

Pay closing costs twice ($8,000-$15,000+ in duplicate fees)

Rate risk: If rates increase during construction, permanent loan costs more

Must re-qualify for permanent loan after construction

More complexity with two applications

Best for: Buyers who own land free and clear, expect rates to drop, or can't qualify for one-time close.

Current recommendation: With volatile rates, most advisors recommend one-time close loans to lock rates early.

What Lenders Require

Construction loans require more documentation than traditional mortgages because you're financing a home that doesn't exist yet.

1. Complete Architectural Plans

What lenders need:

Final architectural drawings stamped by licensed architect

Complete specifications (materials, finishes, fixtures)

Site plan and elevations

Why it matters: Lenders use plans to verify your budget is realistic and order an appraisal of future completed value.

Timeline impact: Most lenders won't start underwriting until you finish the design phase.

2. Detailed Construction Budget

Required format: Line-item budget showing:

Site work and foundation

Framing and materials

Mechanical, electrical, plumbing

Interior and exterior finishes

Permits, fees, contingency

Builder requirements: Lenders verify your builder is licensed, insured, financially stable, and has completed similar projects.

At Mission Home Builders, we provide lender-ready budgets formatted to meet underwriting requirements.

3. Appraisal of Future Value

The lender orders an appraisal estimating completed value based on your plans, comparable sales, and cost approach.

Loan-to-value limits: Most lenders limit loans to 80-90% of appraised completed value.

Example:

Land: $500,000

Construction: $1,000,000

Total cost: $1,500,000

Appraised value: $1,650,000

Maximum loan (80% LTV): $1,320,000

Your required cash: $180,000 minimum

If appraisal comes in low, you need additional cash to cover the gap.

4. Credit and Income Requirements

Minimum credit scores:

One-time close: 680+ for best rates (640+ possible with higher rates)

Two-time close: Some lenders accept 620+

Debt-to-income: Most lenders limit total debt to 43-45% of gross monthly income.

Income documentation:

W-2 employees: 2 years tax returns, recent pay stubs

Self-employed: 2 years tax returns, year-to-date P&L, CPA letter

5. Down Payment and Reserves

Down payment: Typically 20% of total project cost or appraised value, whichever is lower.

Cash reserves: Lenders require 3-6 months of housing payment (PITI) in liquid reserves after closing.

Down payment sources:

Cash savings

Equity from selling existing home

Gift funds from family (requires gift letter)

Land equity if owned free and clear (some lenders)

The Construction Draw Process

Understanding draws prevents cash flow problems and keeps projects on schedule.

How It Works

Step 1: Builder requests draw When your builder completes a milestone, they submit documentation:

Invoice for work completed

Lien waivers from subcontractors

Photos of work

Step 2: Lender inspects Lender sends inspector to verify work matches the draw request (typically within 3-5 business days).

Step 3: Lender funds If inspection passes, funds release in 5-7 business days. Funds go to builder, subcontractors, or suppliers.

Step 4: Repeat Process continues through each phase until final completion.

Common Draw Problems

Problem: Slow approvals delay construction Some lenders take 2-3 weeks to process draws, forcing builders to stop work.

Solution: Choose lenders experienced with construction lending who commit to 7-10 day turnaround. Ask your builder which lenders they prefer.

Problem: Running out of contingency Tight budgets leave no funds to finish the home.

Solution: Build 10-15% contingency into your budget. Lenders hold back 5-10% until Certificate of Occupancy.

Interest During Construction

Interest-Only Payments

During construction, you make interest-only payments on drawn amounts only.

Example:

Total loan: $1,200,000

After foundation (~$200,000 drawn): $200,000 × 7.5% ÷ 12 = $1,250/month

At completion ($1,200,000 drawn): $1,200,000 × 7.5% ÷ 12 = $7,500/month

After Construction

One-time close: Automatically converts to permanent mortgage with principal and interest. Rate was locked at initial closing.

Two-time close: Construction loan pays off when you close permanent mortgage.

Down Payment and Cash Requirements

Total Cash Needed

Minimum cash = Down payment + closing costs + reserves + contingency

Example:

Land: $500,000

Construction: $1,000,000

Total project: $1,500,000

Down payment (20%): $300,000

Closing costs (3%): $45,000

Reserves (6 months at $7,500/mo): $45,000

Contingency (10% of construction): $100,000

Total cash needed: $490,00

Using Land Equity

If you own land free and clear: Some lenders allow land equity toward down payment.

Example:

Land appraised: $500,000

Construction: $1,000,00

Total: $1,500,000

Loan (80%): $1,200,000

Land equity covers $300,000 down payment requirement

Still need ~$145,000 cash for closing costs, reserves, and contingency

If land has a mortgage: Most lenders require paying off the land loan at closing, increasing cash requirements.

Gift Funds

Most lenders allow gift funds from family with proper documentation:

Gift letter stating amount and confirming it's not a loan

Some lenders require 5% down from your own funds

Donor must provide bank statements

Approval Timeline

Total: 6-10 Weeks

Pre-qualification (1-3 days): Preliminary approval amount based on basic financial info.

Full application (1-2 weeks): Submit complete documentation including plans and builder's budget.

Underwriting and appraisal (3-4 weeks):

Appraisal ordered and completed: 10-14 days

Underwriting review: 5-10 business days

Approval to closing (1-2 weeks): Final steps including title work, insurance, and walk-through.

How to accelerate:

Have complete architectural plans before applying

Provide all documentation upfront

Work with builders who provide lender-ready budgets

Choose lenders experienced with construction

Common Financing Mistakes

Mistake 1: Applying Before Plans Are Complete

The trap: Trying to get approval while finalizing design.

Why it fails: Lenders can't appraise or verify budgets without complete plans.

Solution: Complete architectural plans before applying.

Mistake 2: Underestimating Cash Needs

The trap: Calculating only down payment without closing costs, reserves, and contingency.

Why it fails: Discovering you're $40,000 short two weeks before closing.

Solution: Calculate true needs = down payment + closing costs (3%) + reserves (6 months PITI) + 10% contingency.

Mistake 3: Choosing Lenders on Rate Alone

The trap: Selecting lowest rate without evaluating draw process or construction experience.

Why it fails: A lender at 6.5% taking 3 weeks for draws costs more in delays than one at 6.75% funding in 7 days.

Solution: Ask builders which lenders they prefer.

Mistake 4: Inadequate Contingency

The trap: Building exactly to maximum loan amount with zero cushion.

Why it fails: Rock excavation, upgraded tile, or other changes blow through budget before completion.

Solution: Budget actual build at 85-90% of approved amount, keeping 10-15% buffer.

Frequently Asked Questions

What credit score do you need for a construction loan?

Most lenders require 680 for one-time close and 640 for two-time close, though some accept 620+ with higher rates. Scores above 740 qualify for best rates. Below 640, consider FHA construction loans accepting scores as low as 580.

Can you get a construction loan with 10% down?

Some lenders offer 10-15% down for borrowers with excellent credit (740+) and strong reserves, but these require PMI and higher rates. Most recommend 20% down to avoid PMI and secure better terms.

How much do builders require upfront?

Most builders work off the draw schedule without large upfront deposits. Mission Home Builders operates on lender draws—we get paid as we complete work. Some builders require 10% deposit at contract signing. Avoid builders demanding 30-50% upfront.

What happens if construction goes over budget?

You must: (1) Bring additional cash, (2) Reduce scope by eliminating features, or (3) Request additional financing (often declined). This is why 10-15% contingency is critical.

Can you refinance a construction loan before it converts?

One-time close loans typically cannot refinance until after conversion. Two-time close gives flexibility to shop for permanent financing when construction completes.

How long does it take to build after loan approval?

Most Austin custom homes take 8-10 months to construct after permits approve and loans fund. Total timeline from design through completion averages 12-14 months.

Ready to Explore Financing?

Construction financing requires more preparation than traditional mortgages, but understanding the process prevents mistakes. Most Austin buyers succeed with one-time close loans that lock rates early, minimize costs, and provide certainty throughout the build.

Mission Home Builders guides clients through construction financing from budgeting through final conversion. We provide detailed lender-ready budgets, coordinate with your chosen lender throughout draws, and ensure construction stays on schedule and budget.

Ready to discuss financing options?

Schedule a consultation to review your budget, discuss realistic project costs, and connect with construction lenders we've successfully worked with.

Contact Mission Home Builders: